How Are UAE Financial Scene Commodity Trading Platforms Changing?

It is already well known that the United Arab Emirates (UAE) with the support of innovative leaders and significant economic activity is one of the most important financial centers in the world. There are unique trends in commodity trading platforms in UAE that are soon to alter the financial landscape .This is perhaps one of the biggest trends seen emerging in recent times. It indicates that the management and trading of commodities in the region’s methods is evolving due to opportunities, efficiency, and new developments introduced by platforms.

Commodity Trading’s Development in the United Arab Emirates

In the earlier past, the UAE prospered mainly due to its earnings from oil exports. The economic activities however have slowly diversified in the recent past to include several sectors including trade, property, finance and business, and tourism. This new diversification approach contains the following essential components, where one of the central ones is now commodity trading.

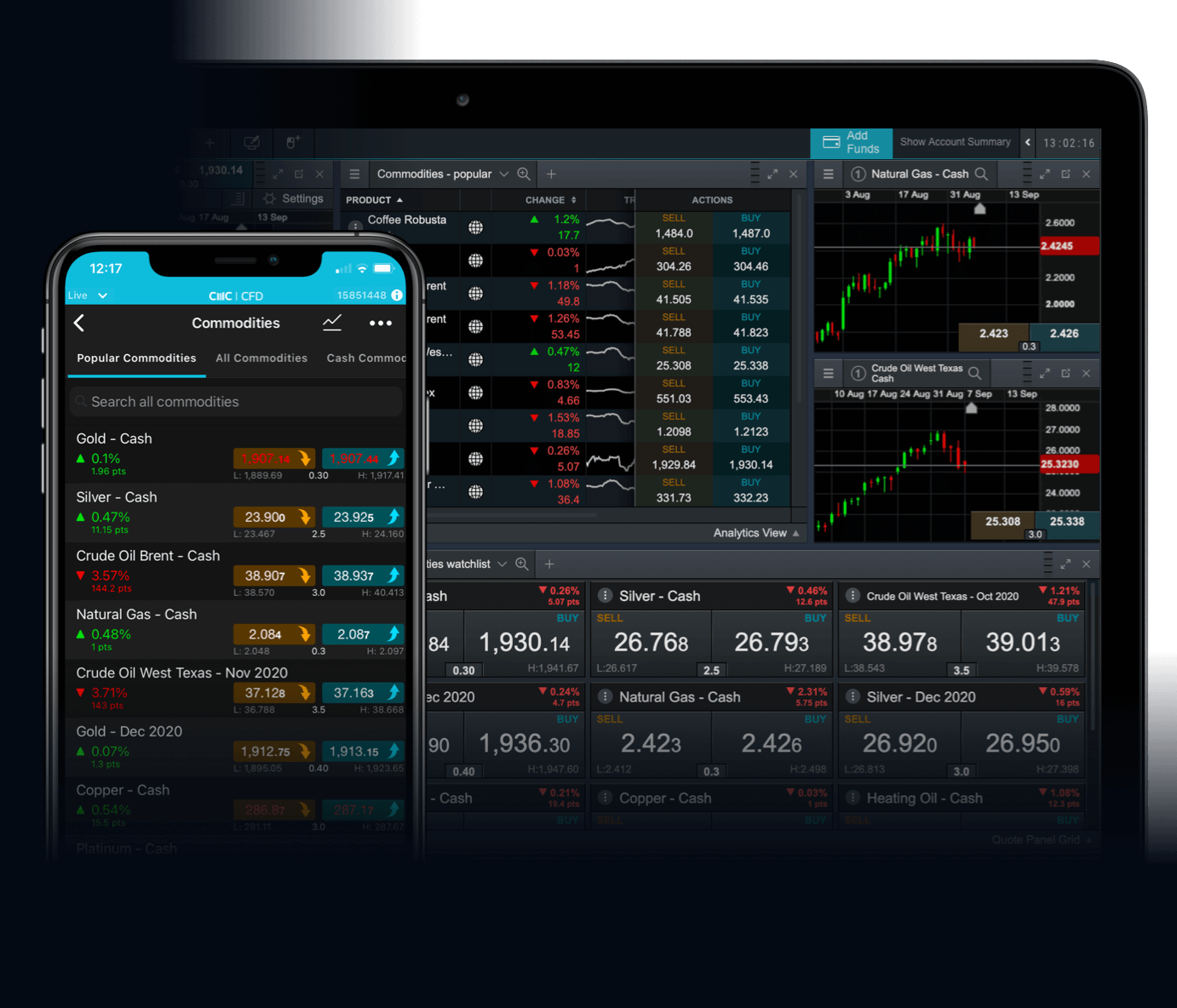

Trading platforms for commodities thus emerged in this environment and benefitted from the United Arab Emirates’ strategic location that put it in the middle of East and West and the advanced technology solutions available. It is due to the efforts of these platforms, to enable buyers and sellers to transact more easily and transparently in some goods such as natural gas, gold, oil, and agricultural products among others through the digital marketplace

Improved Availability of the Market

The availability of markets overseas is among the primary areas through which the commodities trading platforms have had a transformational impact throughout the United Arab Emirates. Especially, until the invention of efficiently regulated commodity exchanges, commodity futures trading was restricted only to large enterprises and financially sound institutions. Newcomers in the market include SMEs and individual investors Specifically, liberalisation of access to the market through digital platforms has enabled liberalisation of the market.

For the case of enabling traders to make appropriate decisions, the platforms provide real-time data, analytical capabilities, and tutorial resources. It signifies that via this accessibility more players can engage in the trading of commodities in an open network. which supports the overall expansion and vibrancy of the financial sector in the United Arab Emirates.

Enhancing Efficacy and Openness

Market efficiency and transparency have increased dramatically thanks to commodity trading platforms. Trading in commodities used to entail intricate procedures that were frequently opaque and prone to fraud and mistakes. Because digital platforms offer a centralised marketplace where all transactions are tracked and documented in real-time, these procedures have been reduced.

To improve transparency and security even more, these platforms are integrating cutting-edge technologies like blockchain. With blockchain, there is less chance of fraud and greater participant trust because every transaction is guaranteed to be verifiable and unchangeable. Better price discovery as a result of the enhanced openness has ensured that commodity prices accurately represent the state of the market.

Improved Market Depth and Liquidity

The extent of the market and the effectiveness of the financial markets in the United Arab Emirates has improved with the trading of commodity platforms. These platforms enable higher and more frequent transaction volumes by offering a digital marketplace with more players. Faster transaction execution and a diminished effect of large deals on market prices are two advantages of this improved liquidity for traders.

Deeper and more robust markets have also been facilitated by the participation of a wide range of players, including institutional investors, individual traders, and foreign organizations. The presence of buyers and sellers is guaranteed by this increased market depth, which lowers volatility and stabilizes prices.

Encouraging Technological Progress and Innovation

Innovators and technology innovators in the financial sector are led by UAE commodity trading platforms. This new age has witnessed remarkable changes in the field of commodity trading and management with the help of advanced tools such as artificial intelligence, machine learning and other tools.

Market data and trends are gathered, data is processed, and along with artificial intelligence, machine learning is used to make predictive calculations. It makes trading more predictable and allows traders to make better selections. A more strategic approach to trading is made possible by the greater insights that big data analytics offers into market trends and behaviors.

Additionally, to integrate new technologies and enhance user experience, these platforms are always changing. New ideas are being investigated to increase productivity and lessen the dependency on manual procedures, such as automated trading platforms and smart contracts.

Encouraging Adherence to Regulations

To manage the instabilities that may arise in the financial markets, the United Arab Emirates has strict rules on its regulation. For this reason, it cannot be overemphasized the critical role of the platforms to provide clear and easily auditable records of all transactional activities.

To guarantee that all trade activities comply with national and international standards, digital platforms frequently include compliance tools. These include the know-your-customer (KYC) policies, reporting requirements, and anti-money laundering (AML) measures across its offerings. These platforms lessen traders’ responsibilities and support the upkeep of an open and honest trading environment by optimizing compliance procedures.

Encouraging Ecological Approaches

Being an oil-rich nation and meeting the environmental challenges in the context of its economic growth, the UAE gives high importance to sustainability.

How Commodity Trading Platforms are driving sustainability: Some of the ways through which various trading markets in commodities are currently trying to strengthen their sustainability include the promotion of green products, supporting ecological products, and trading in environmentally friendly products. They can also facilitate access to sustainable investment opportunities in such areas as, for example, the improved trading of Renewable Energy Certificates and carbon credits.

Moreover, due to the possibilities provided by openness and traceability, environmental, and social impact assessment is enhanced due to the new possibilities offered by digital platforms. Aiding toward the UAE’s mission to have an environmentally sustainable future, this confirms also that the commodities they procured and dealt with signify sustainability values.

Conclusion: Trading

Owing to commodity trading platforms, the financial structure of The United Arab Emirates is changing prosaically. As many persons speculate, these platforms are revolutionizing the way commodities are being traded and managed by opening up new markets, enhancing market depth, providing a more transparent and efficient environment, and encouraging new development. At the same time, they contribute to the promotion of sustainable practices, compliance with regulatory framework, support of the economic diversification strategy, and SMEs.